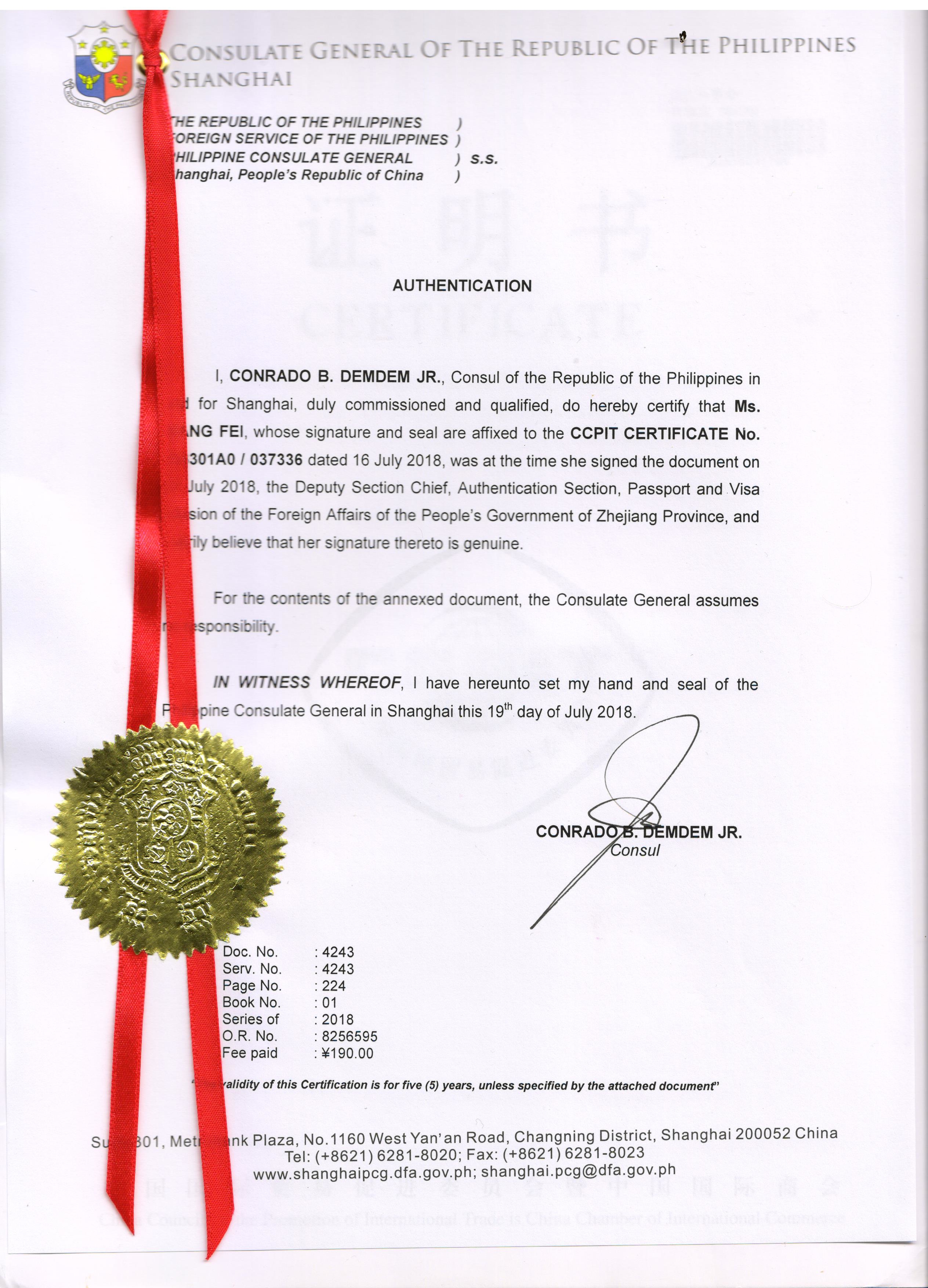

合同菲律宾墨西哥大使馆认证MOXIGE

合同要认证正本文件

出口单证知识

在国际航运中,最常见、最重要的单证就是提单。

对于承运人(包括船公司及其代理人)来说,提单是签发给托运人的货物收据。对于托运人来说,提单是物权凭证。

In international shipping, the most common and important document is bill of lading.

For the carrier (including the shipping company and its agent), a bill of lading is a receipt issued to the shipper for the goods. A bill of lading is a title to shipper.

沿海 港口 地区的提单流转,一般按正常程序进行。在最常见的跟单 信用证 结汇方式中,承运人签发提单给托运人后,托运人将提单和 信用证 一同交议付银行结汇。提单上列明的收货人要通过赎单手续取得提单,方可提货。

The circulation of bills of lading in coastal port areas is generally carried out in accordance with normal procedures. In the most common form of documentary credit settlement, the shipper presents the bill of lading and the letter of credit together with the bill of lading to the negotiating bank for settlement. The consignee listed on the bill of lading shall obtain the bill of lading through the redemption procedure before taking delivery.

可是,内陆地区的托运人就会碰到一些麻烦。不少船公司为避免提单管理失控,往往没有指定内陆地区代理人为其签发提单,而是在货物启运港签发好提单再寄给内陆地区的托运人(即 港口 签单方式)。

Inland shippers, however, will have some trouble. Many shipping companies in order to avoid the bill of lading management out of control, often do not appoint agents in the inland areas for its issue of bills of lading, but in the port of shipment of goods issued a good bill of lading and then sent to the inland areas of the shipper (that is, the port documents).

邮寄需要一段时间,某些情况下达数天之久,于是产生几点问题:

1.内陆地区的托运人收到提单为时较晚,到议付行结汇就迟了,有利息损失。

2.内陆地区的托运人在收到提单后,如发现提单有打错的地方,则必须将提单寄回启运港更正。相隔遥远,沟通困难,甚至被迫派人专程去启运港更正。

3.有时 信用证 已到期,托运人只得用打错的提单去担保结汇,或在信用证过期后才拿到正确的提单,甚至在信用证过期后才拿到错的提单,被迫担保结汇,从而承担了巨大风险,陷于被动境地。根据世界通行的国际商会第500号出版物规定,在此情况下,收货人可拒收货物、不付款或要求减价等。如收货人居心不良,托运人就要吃大亏。

The mail takes a while, in some cases days, and raises a few questions:

The shipper in the inland area receives the bill of lading late, and is late for the settlement of exchange by the negotiating bank, resulting in loss of interest.

The inland shipper shall, upon receipt of the Bill of lading, return it to the port of departure for correction if any discrepancy is found in the bill of lading. Distant, difficult communication, even forced to send a special trip to the port of departure correction.

3. Sometimes, when the letter of credit expires, the shipper has to use the wrong bill of lading to guarantee the settlement of foreign exchange, or get the right bill of lading after the expiry of the letter of credit, or even get the wrong bill of lading after the expiry of the letter of credit, and is forced to guarantee the settlement of foreign exchange, thus taking huge risks and falling into a passive position. In this case, the consignee may refuse to accept the goods, withhold payment or request a reduction in price, etc., in accordance with ICC Publication no. 500 for World Use. If the consignee has bad intentions, the shipper will suffer great losses.