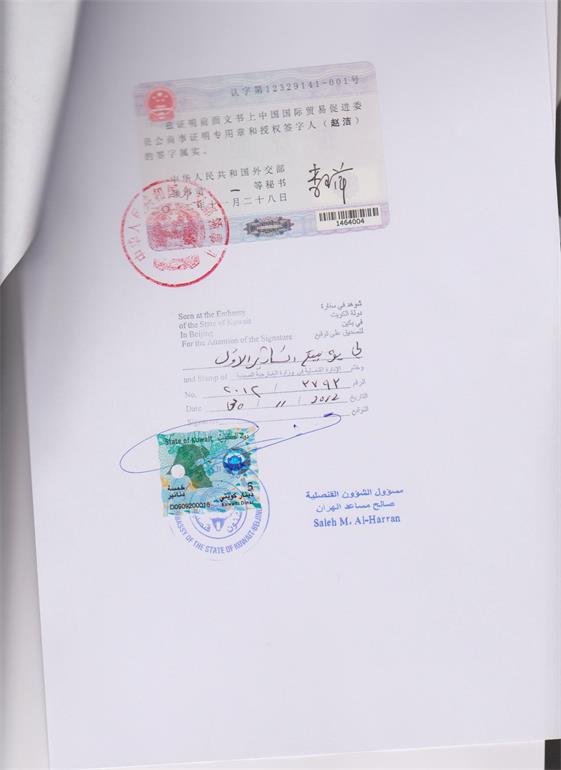

大 使 馆 认 证

信用证和销售协议科威特大使馆认证(ENGLISH)

在国际贸易中,信用证是一种常用的工具,而且种类繁多,贸易公司可以根据自身发展的需要进行选择。那么信用证有效期一般多久?

In international trade, letter of credit is a common tool, and a wide variety of trading companies can choose according to their own development needs. Then how long is the letter of credit valid?

一、信用证有效期一般多久

信用证有效期是由开证人决定的,一般开证申请人会定在交货期20天左右。 L/C规定受益人议付应该在出货15-21天,出货这个概念有笼统,有的时候开证人要求是进仓后15--21天,有时候是船开15--21天,有时候是提单签发日15--21天,这取决于开证人。 另外,国际惯例中规定,议付行收到议付单据后2周内必须给与议付,这个日期不是明文规定的,而是国际上的惯例。

How long is the validity of the letter of credit generally

The validity of the l/C is decided by the applicant. Generally, the applicant will set the date of delivery at about 20 days. L/C stipulates that beneficiary's negotiation should be in 15-21 days after shipment. The concept of shipment is general. Sometimes the applicant requires 15-21 days after warehouse entry, sometimes 15-21 days after ship sailing, and sometimes 15-21 days after bill of lading is issued, depending on the applicant. In addition, it is stipulated in international practice that negotiation bank must make negotiation within 2 weeks after receiving negotiation documents. This date is not explicitly stipulated, but is an international practice.

二、信用证的开立

1、开证的申请

进出口双方同意用跟单信用证支付后,进口商便有责任开证。第一件事是填写开证申请表,这张表为开证申请人与开证行建立了法律关系,因此,开证申请表是开证的最重要的文件。

Issuance of letter of credit

1. Application for Opening L/C

The importer will be liable to open the L/C after the parties have agreed to pay by documentary L/C. The first thing is to fill in the application form for issuing Credit. This form establishes a legal relationship between the applicant and the issuing bank. Therefore, the application form is the most important document for issuing Credit.

2、开证的要求

信用证申请的要求在统一惯例中有明确规定,进口商必须确切地将其告之银行。信用证开立的指示必须完整和明确。申请人必须时刻记住跟单信用证交易是一种单据交易,而不是货物交易。银行家不是商人,因此申请人不能希望银行工作人员能充分了解每一笔交易中的技术术语。即使他将销售合同中的所有条款都写入信用证中,如果受益人真的想欺骗,他也无法得到完全保护。这就需要银行与申请人共同努力,运用常识来避免开列对各方均显累赘的信用证。银行也应该劝阻在开立信用证时其内容套用过去已开立的信用证(套证)。

2. Requirements for Opening L/C

The requirements of an application for a letter of credit are specified in the Uniform Customs and Practice that the importer must inform the bank exactly what has been done. The instructions to issue the credit must be complete and clear. The applicant must always bear in mind that a documentary credit transaction is a document transaction and not a goods transaction. A banker is not a businessman, so an applicant cannot expect a banker to know the technical jargon of every transaction. Even if he had written all the terms of the sales contract into the letter of credit, he would not have been fully protected if the beneficiary really wanted to deceive him. This requires the bank to work with the applicant and use common sense to avoid writing letters of credit that are burdensome to all parties. Banks should also discourage issuing letters of credit in the form of letters of credit already issued in the past.

3、开证的安全性

银行接到开证申请人完整的指示后,必须立即按该指示开立信用证。另一方面,银行也有权要求申请人交出一定数额的资金或以其财产的其他形式作为银行执行其指示的保证。按现行规定,中国地方、部门及企业所拥有的外汇通常必须存入中国的银行。如果某些单位需要跟单信用证进口货物或技术,中国的银行将冻结其帐户中相当于信用证金额的资金作为开证保证金。如果申请人在开证行没有帐号,开证行在开立信用证之前很可能要求申请人在其银行存入一笔相当于全部信用证金额的资金。这种担保可以通过抵押或典押实现(例如股票),但银行也有可能通过用于交易的货物作为担保提供融资。开证行首先要对该笔货物的适销性进行调查,如果货物易销,银行凭信用证给客户提供的融资额度比滞销商品要高得多。

4、申请人与开证行的义务和责任

申请人对开证行承担三项主要义务:

(1)申请人必须偿付开证行为取得单据代表代向受益人支付的贷款。在他付款前,作为物权凭证的单据仍属于银行。

(2)如果单据与信用证条款相一致而申请人拒绝"赎单",则其作为担保的存款或帐户上已被冻结的资金将归银行所有。

(3)申请人有向开证行提供开证所需的全部费用的责任。

开证行对申请人所承担的责任:

首先,开证行一旦收到开证的详尽指示,有责任尽快开证。

其次,开证行一旦接受开证申请,就必须严格按照申请人的指示行事。

综上所述,我们可以得知,信用证有效期是由开证人决定的,一般开证申请人会定在交货期20天左右。