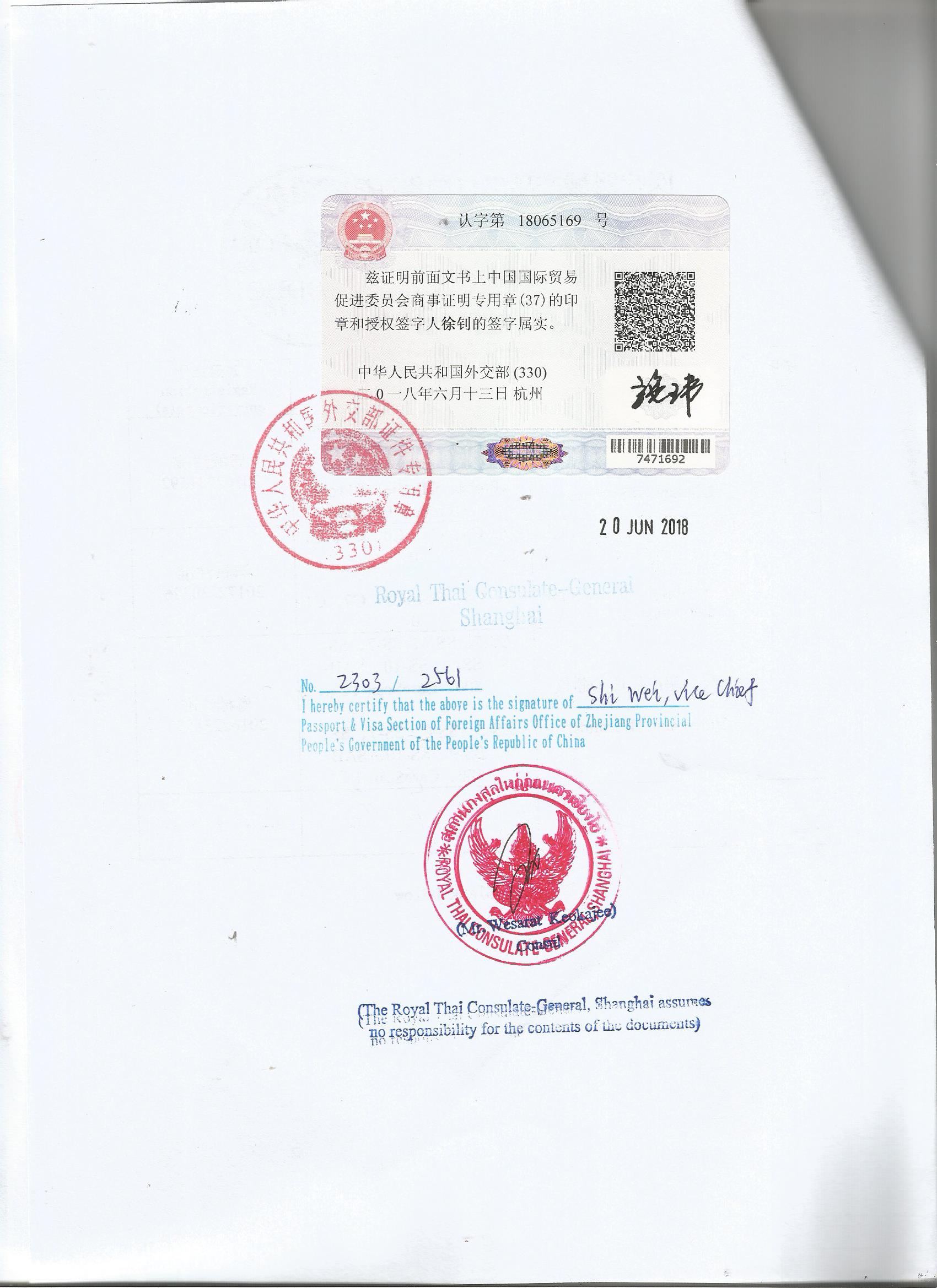

信用证AND检测证书泰国使馆认证

大 使 馆 认 证---领 事 馆 认 证---贸 促 会 认 证---香 港 商 会 认 证---香 港 海 牙认 证--原 产 地 证 书→→→

备用信用证的种类很多,根据在基础交易中备用信用证的不同作用主要可分为以下8类:

1、履约保证备用信用证(PERFORMANCE STANDBY)——支持一项除支付金钱以外的义务的履行,包括对由于申请人在基础交易中违约所致损失的赔偿。

There are many types of standby letters of credit, which can be divided into the following eight categories according to their different functions in basic transactions:

1. PERFORMANCE STANDBY Letter of Credit -- Supporting the PERFORMANCE of an obligation other than payment of money, including compensation for losses due to the applicant's breach of contract in the underlying transaction.

2、预付款保证备用信用证(ADVANCE PAYMENT STANDBY)——用于担保申请人对受益人的预付款所应承担的义务和责任。这种备用信用证通常用于国际工程承包项目中业主向承包人支付的合同总价10%-25%的工程预付款,以及进出口贸易中进口商向出口商支付的预付款。

ADVANCE PAYMENT STANDBY letter of credit -- used to guarantee the applicant's obligation and responsibility to the beneficiary for making ADVANCE PAYMENT. The standby letter of credit is usually used for the advance payment of 10% to 25% of the total contract price to the contractor by the owner of the international project and the advance payment of the importer to the exporter in the import and export trade.

3、反担保备用信用证(COUNTER STANDBY)——又称对开备用信用证,它支持反担保备用信用证受益人所开立的另外的备用信用证或其他承诺。

4、融资保证备用信用证(FINANCIAL STANDBY)——支持付款义务,包括对借款的偿还义务的任何证明性文件。目前外商投资企业