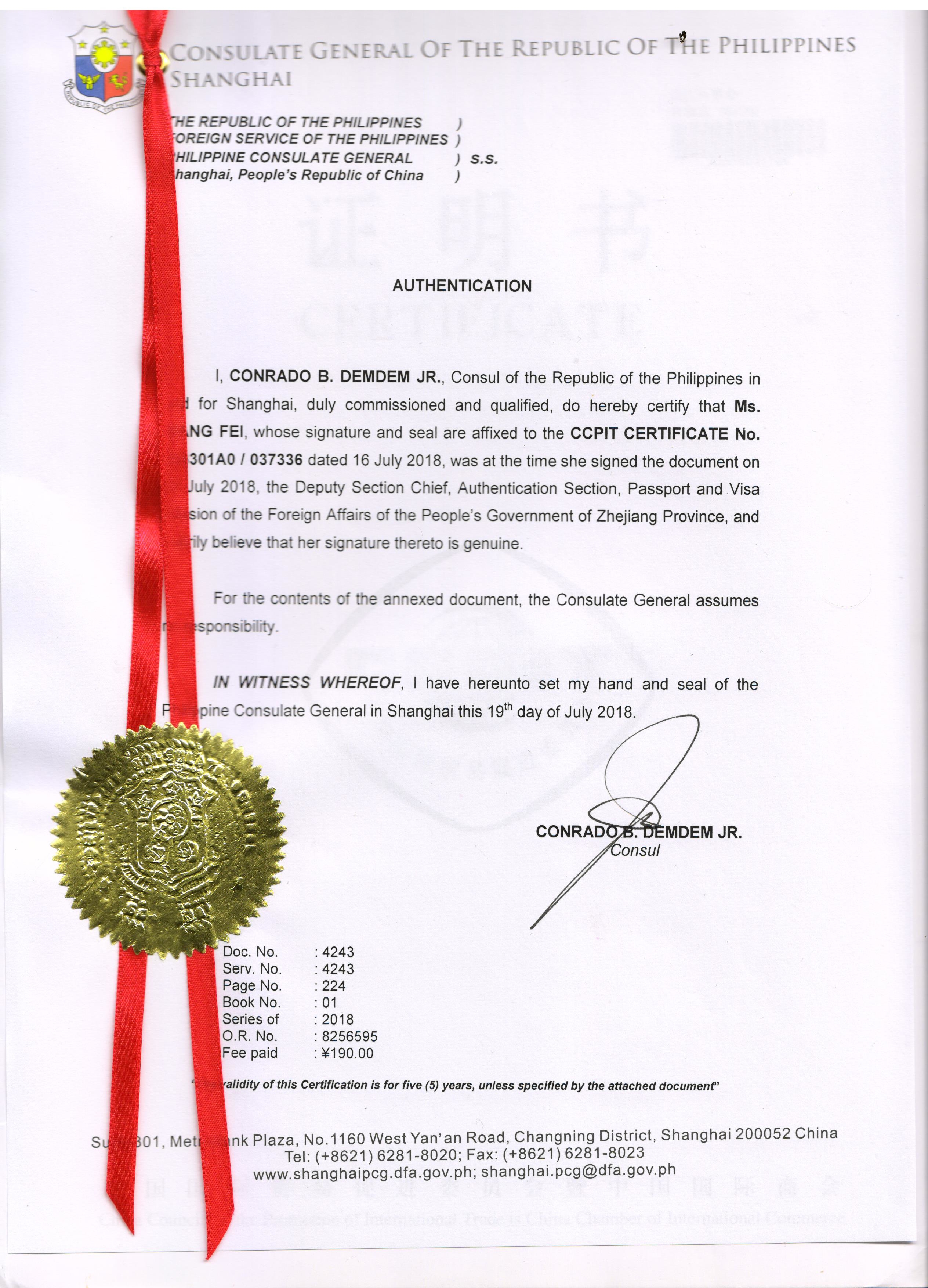

假提单风险:菲律宾公司章程大使馆认证HUBEI

大 使 馆 认 证 助 手-- 在 华 领 事 馆 认 证 帮 手-- 贸 促 会 认 证-- 香 港 商 会 认 证-- 香 港 未 再 加 工 证 明--@ 我

国际贸易中,风险防范问题正越来越引起各方面的关注。在运输方面,因为远隔重洋的关系,货物的发运、货物的提取只能凭借一纸提单为证,因而也就出现了诸如 倒签提单、假提单(鬼船提单)等风险。我们遇见最多的还是倒签提单,这方面更应该 引起警觉。

In international trade, risk prevention is attracting more and more attention from all sides. In terms of transportation, due to the long distance between the oceans, the goods can only be dispatched and picked up on the basis of a bill of lading, so there are risks such as backdated bills of lading, false bills of lading (ghost ship bills of lading) and so on. What we see most often is backdated bills of lading. We should be more alert in this regard.

对于货主来说,航运中的风险主要有两种,一种是货损货差和延迟交付,另一种 是与欺诈有关的提货而不付款。

For shippers, there are two main risks in shipping. One is loss of goods and late delivery, and the other is fraud related to taking delivery without payment.

对第一类风险,有比较明确的国际法和各国法律来判 断责任所在,而第二类风险实在更加诡谲。

For the first type of risk, there are relatively clear international and national laws to determine the responsibility, while the second type of risk is more complicated.

有一些进口商出于有意欺诈的目的,首先迎合出口商希望 信用证 支付方式安全可靠的心理,在 信用证 中设置一些软条款,如客检证等,使议付时发生不符,出口商无法从银行取得货款,同时,在 信用证 中又指定 货运代理,可以不通过银行而通过货代取得货物。Some importers for deliberately fraud purposes, first to cater to the safe and reliable exporters hope to payment by l/c, set some soft clauses in l/c, such as guest testing, make negotiation occurs when discrepancy, exporters unable to obtain payment from the bank, at the same time, and specified in the l/c freight forwarders, can not by forwarding the goods by the bank.