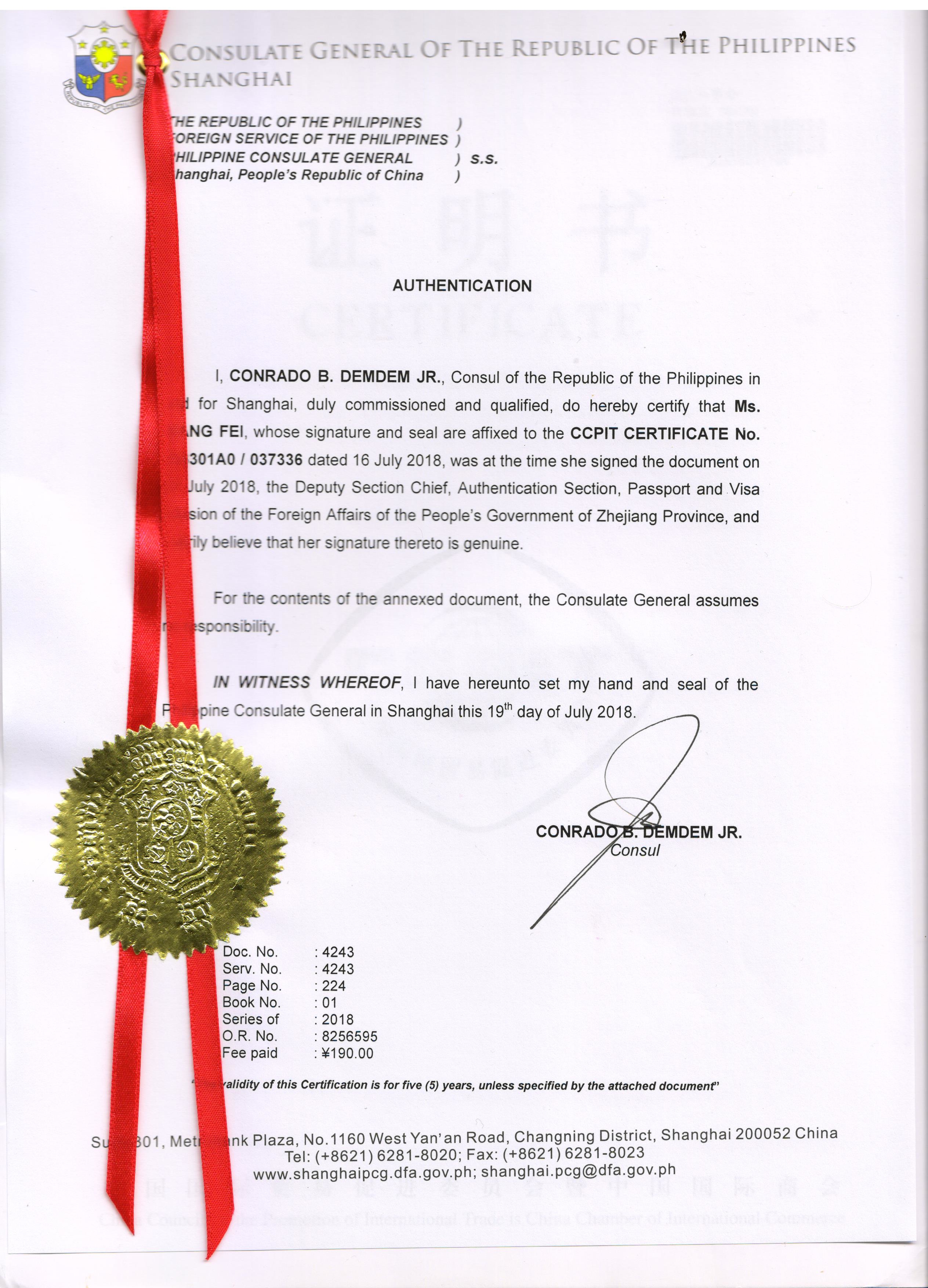

菲律宾GMP领事认证

做大使馆认证首先要备齐要资料

需要清晰地扫描件即可

需要清晰地营业执照副本复印件扫描件

需要生产许可证书正本一份

菲律宾大使馆认证出单时间是8-10个工作日左右

菲律宾大使馆认证的地点是(北京 广州 重庆 深圳 上海)等地方领事!

菲律宾大使馆认证的方式:先做公证然后再做使馆双认证!

菲律宾使馆认证出单后再行付款事宜!

资料必须真实有效:字迹公证干净字体一致。

菲律宾使馆认证在国外的作用:相关机构备书。使其后期事宜顺利展开。

菲律宾使馆认证的费用是每个国家的定价不一样,没有统一的标准!

信用支付程序

信用支付程序

1. 进出口人在贸易合同中,规定使用信用证支付方式。

2. 进口人向当地银行提交开证申请书,同时交纳押金或其它保证。

3. 开证行根据申请内容,向出口人(受益人)开出信用证,并寄交通知银行。

4. 通知行核对印鉴或密押无误后,将信用证寄交给出口人。

5. 出口人审核信用证与合同相符合后,按照信用证规定装运货物,并备齐各项信用证要求的货运单据,在信用证有效期内,寄交议付行议付。

6. 议付行按照信用证条款审核单据无误后,按照汇票金额扣除利息,把货款垫付给出口人。

7. 议付行将汇票和货运单据寄开证行(或其指定的付款行)索偿。

8. 开证行(或其指定的付款行)核对单据无误后,付款给议付行。

9. 开证行通知进口人付款赎单。

Credit payment procedure

1. It is stipulated in the trade contract that the importer and exporter shall use the letter of credit for payment.

2. The importer shall submit an application for opening l/C and pay a deposit or other guarantee to a local bank.

3. The opening bank shall open the l/C to the exporter (beneficiary) according to the application and forward it to the advising bank.

4. The advising bank shall check the seal or secret order and forward the l/C to the exporter.

After verifying the conformity of the l/C with the contract, the exporter shall ship the goods in accordance with the stipulations of the L/C and prepare all the shipping documents required by the L/C, and send them to the negotiating bank for negotiation within the validity of the L/C.

6. After checking the documents in accordance with the terms of the credit, the negotiating bank will advance the payment to the exporter after deducting interest from the amount of the draft.

7. The negotiating bank will send the draft and shipping documents to the issuing bank (or its nominated drawee bank) for reimbursement.

8. The issuing bank (or its nominated drawee bank) verifies the documents to make payment to the negotiating bank.

9. The issuing bank notifies the importer of payment.