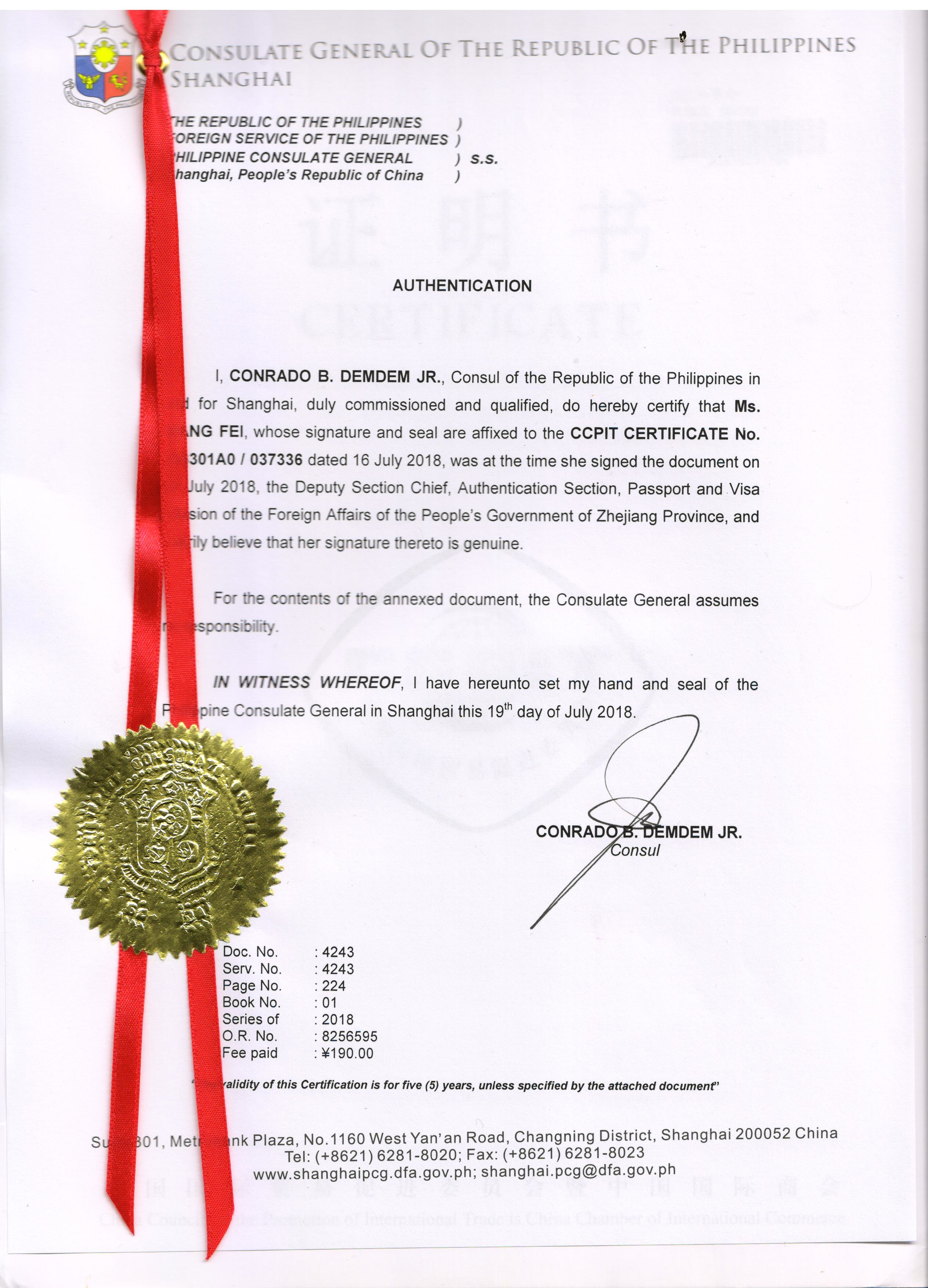

菲律宾许可证书领事认证

做大使馆认证首先要备齐要资料

需要清晰地扫描件即可

需要清晰地营业执照副本复印件扫描件

需要生产许可证书正本一份

菲律宾大使馆认证出单时间是8-10个工作日左右

菲律宾大使馆认证的地点是(北京 广州 重庆 深圳 上海)等地方领事!

菲律宾大使馆认证的方式:先做公证然后再做使馆双认证!

菲律宾使馆认证出单后再行付款事宜!

资料必须真实有效:字迹公证干净字体一致。

菲律宾使馆认证在国外的作用:相关机构备书。使其后期事宜顺利展开。

菲律宾使馆认证的费用是每个国家的定价不一样,没有统一的标准!

信用证种类

信用证种类

一.跟单信用证(DOCUMENTARY CREDIT):是凭跟单汇票或仅凭单据付款的信用证。国际贸易结算中所使用的信用证绝大部分是跟单信用证。

二.光票信用证:是凭不附带单据的汇票付款的信用证。

三.可撤销(REVOCABLE)信用证:是指开证行对所开信用证不必征得受益人同意有权随时撤销的信用证。

四.不可撤销(IRREVOCABLE)信用证:是指信用证一经开出,在有效期内,非经信用证各有关当事人的同意,开证行不能片面修改或撤销的信用证。此种信用证在国际贸易中使用最多。

五.保兑(CONFIRMED)信用证:是指经开证行以外的另一家银行加具保兑的信用证。保兑信用

证主要是受益人(出口商)对开证银行的资信不了解,对开证银行的国家政局、外汇管制过于担心,怕收不回货款而要求加具保兑的要求,从而使货款的回收得到了双重保障。

六.即期信用证:是开证行或付款行收到符合信用证条款的汇票和单据后,立即履行付款义务

的信用证。

七.远期信用证:是开证行或付款行收到符合信用证的单据时,不立即付款,而是等到汇票到期履行付款义务的信用证。

Type of credit

DOCUMENTARY CREDIT: a letter of CREDIT paid against a DOCUMENTARY draft or against documents only. Most letters of credit used in international trade settlement are documentary letters of credit.

Clean letter of credit: a letter of credit payable by draft without accompanying documents.

REVOCABLE letter of credit: a letter of credit that an issuing bank has the right to revoke at any time without the consent of the beneficiary.

IRREVOCABLE (bank's method of credit) : a letter of credit which, once opened, cannot be unilaterally modified or cancelled by the issuing bank within its validity without the consent of the parties concerned. This kind of letter of credit is most used in international trade.

CONFIRMED letter of credit means a letter of credit CONFIRMED by a bank other than the issuing bank. Confirming the credit

The main reason is that the beneficiary (exporter) does not know the credit standing of the issuing bank, and is too worried about the national political situation and foreign exchange control of the issuing bank. For fear of not receiving the payment back, the beneficiary requires confirmation, so that the payment recovery is double guaranteed.

Sight l/C means that the issuing bank or the drawee bank performs the obligation of payment immediately upon receipt of drafts and documents in conformity with the terms of the l/C

L/C.

Usance letter of credit: a letter of credit whereby the issuing bank or the paying bank, upon receipt of documents conforming to the l/C, does not pay immediately, but performs the payment obligation upon the maturity of the draft.