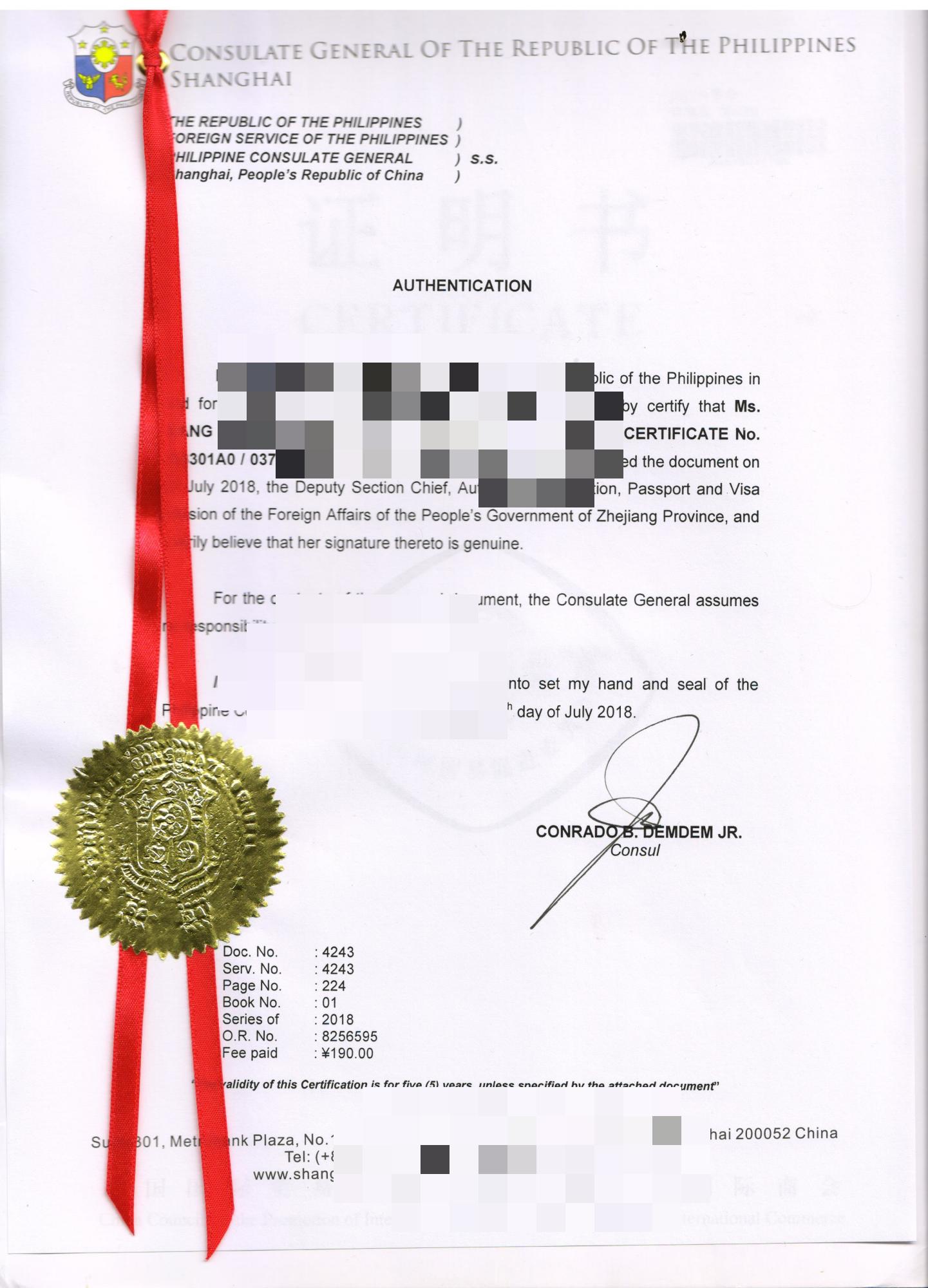

安庆、使馆认证菲律宾加签检测报告

需要营业执照副本一份(拍照和清晰地扫描都可以)

需要9个工作日左右出单

出单的地点是:上海 北京 广州

The global liquidity contraction will push up risk-free interest rates, triggering asset price adjustments and re-pricing risks, according to the agency. For emerging economies, shrinking dollar liquidity and rising interest rates may also prompt capital to flow back to the United States, increasing the risk of capital outflow.

In addition, the contraction of US dollar liquidity tends to boost the strength of the US dollar, and some emerging economies will face currency depreciation pressure, further exacerbating debt risks.

A more recent example came in 2018. Back then, as the Fed raised rates faster, both dollar rates and currencies rose, causing a domino fall in some emerging economies' currencies, including the Russian rouble and Argentine peso, and triggering capital outflows and stock market volatility.