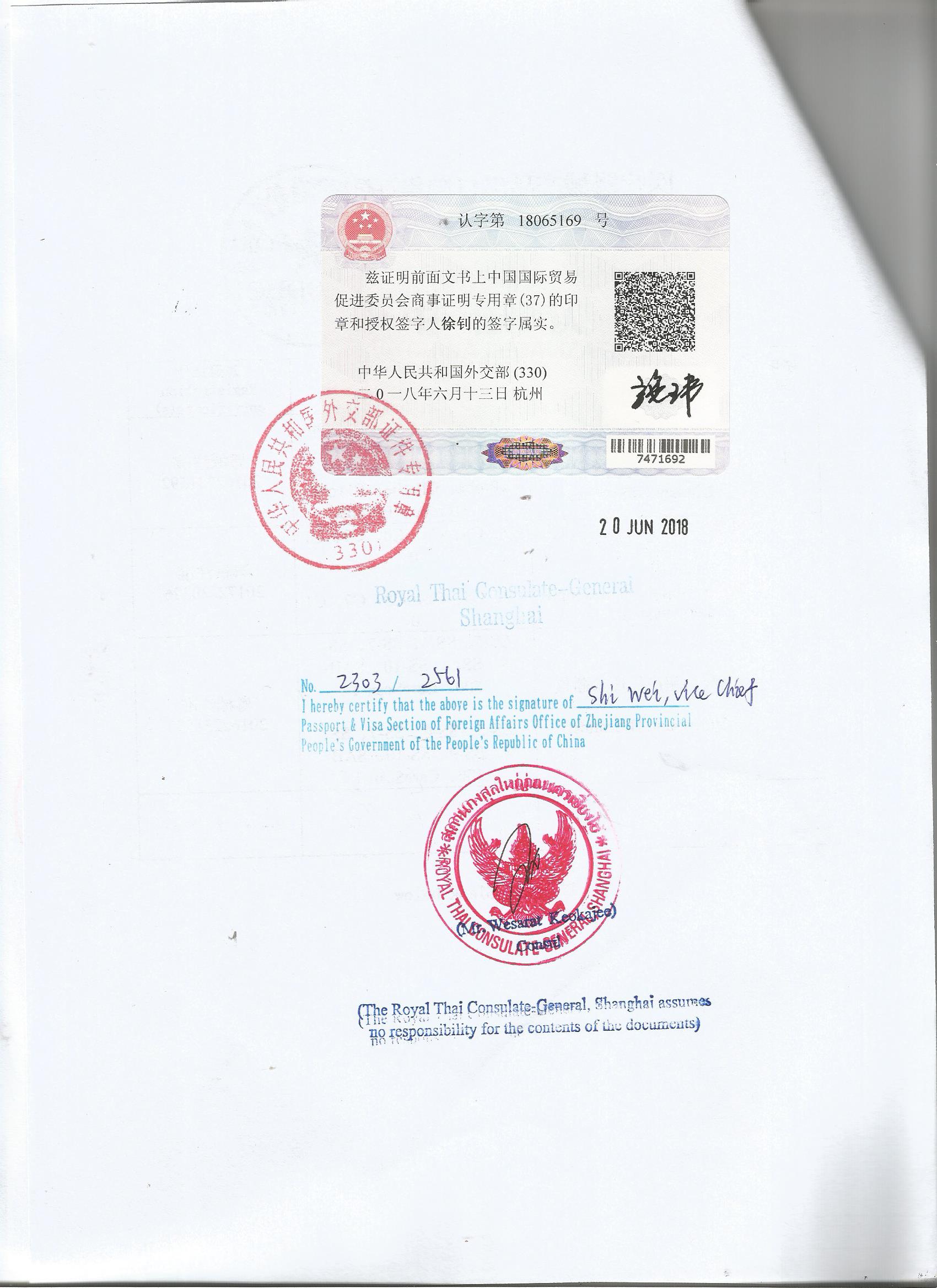

信用证申请:销售证明泰国使馆加签TADILEN

大 使 馆 认 证---领 事 馆 认 证---贸 促 会 认 证---香 港 商 会 认 证---香 港 海 牙认 证--原 产 地 证 书→→

信用证操作流程跟单信用证操作的流程简述如下:

1.买卖双方在贸易合同中规定使用跟单信用证支付。

2.买方通知当地银行(开证行)开立以卖方为受益人的信用证。

3.开证行请求另一银行通知或保兑信用证。

4.通知行通知卖方,信用证已开立。

5.卖方收到信用证,并确保其能履行信用证规定的条件后,即装运货物。

6.卖方将单据向指定银行提交。该银行可能是开证行,或是信用证内指定的付款、承兑或议付银行。

7.该银行按照信用证审核单据。如单据符合信用证规定,银行将按信用证规定进行支付、承兑或议付。

8.开证行以外的银行将单据寄送开证行。

9.开证行审核单据无误后,以事先约定的形式,对已按照信用证付款、承兑或议付的银行偿付。

10.开证行在买方付款后交单,然后买方凭单取货。

The operation process of documentary credit is briefly described as follows:

1. Payment by documentary credit is stipulated in the trade contract between the buyer and the seller.

The Buyer instructs the local bank (issuing bank) to open a letter of credit in favor of the seller.

3. The issuing bank requests another bank to advise or confirm the credit.

4. The advising bank informs the seller that the Credit has been issued.

The seller shall ship the goods on receipt of the L/C and ensure that it complies with the terms and conditions stipulated in the L/C.

6. The seller submits the documents to the nominated bank. This bank may be the issuing bank or the payment, acceptance or negotiation bank specified in the credit.

7. The bank shall review the documents in accordance with the credit. If documents comply with the credit, payment, acceptance or negotiation will be made in accordance with the credit.

8. A bank other than the issuing bank sends the documents to the issuing bank.

9. The issuing bank shall reimburse the bank that has paid, accepted or negotiated in accordance with the credit in a form previously agreed upon after checking the documents to be correct.

10. The issuing bank will deliver the Documents after the buyer pays, and then the buyer will collect the goods against the documents.