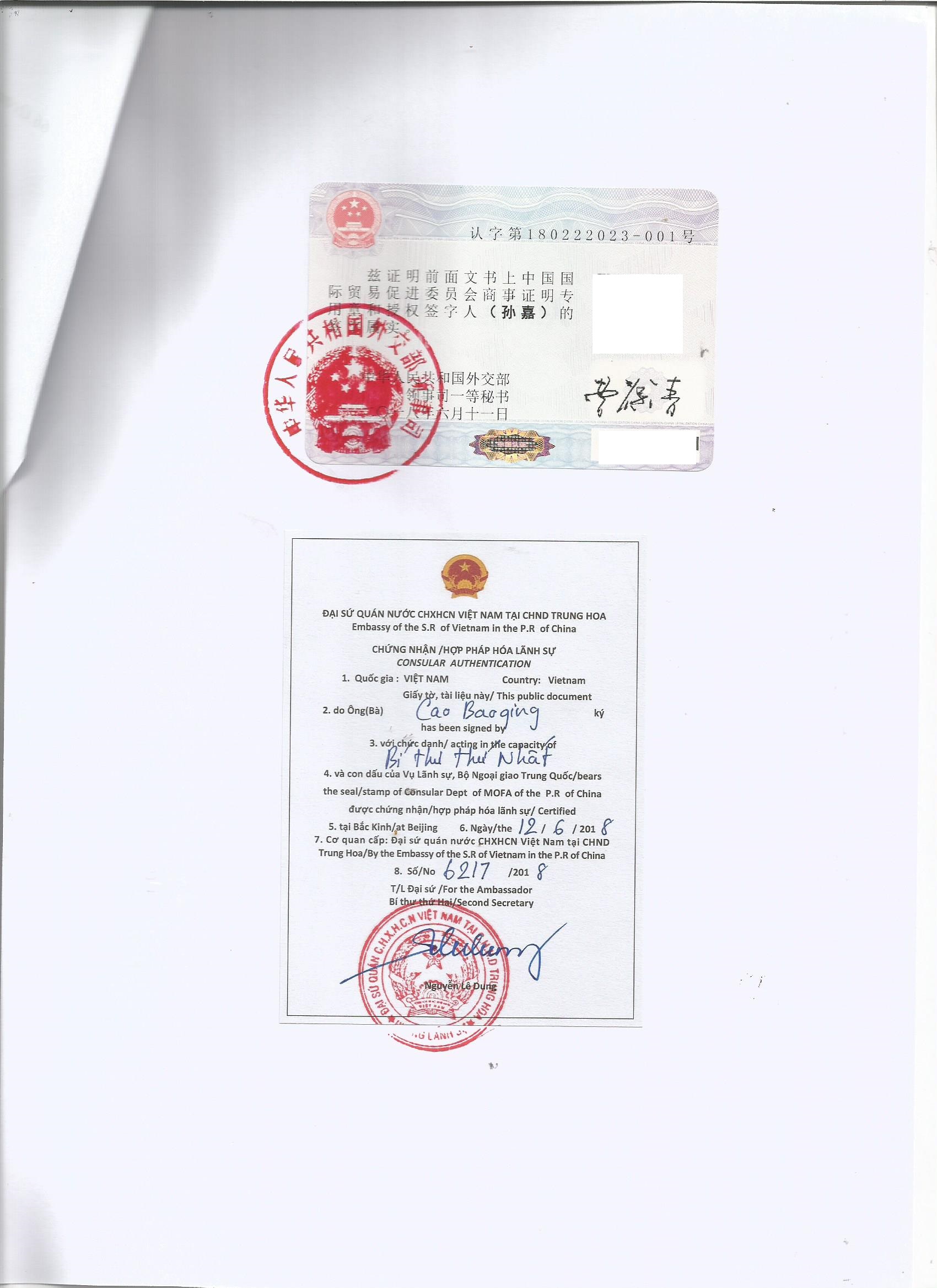

信用证开立-协议越南领事馆认证(Việt nam)

大 使 馆 认 证---领 事 馆 认 证---贸 促 会 认 证---香 港 商 会 认 证---香 港 海 牙认 证--原 产 地 证 书→→

信用证的开立

1.开证的申请 进出口双方同意用跟单信用证支付后,进口商便有责任开证。第一件事是填写开证申请表,这张表为开证申请人与开证行建立了法律关系,因此,开证申请表是开证的最重要的文件。

Issuance of Letter of credit

The importer will be liable to open the L/C after the parties to the import and export agree to pay by documentary L/C. The first thing is to fill in the application form for issuing Credit. This form establishes a legal relationship between the applicant and the issuing bank. Therefore, the application form is the most important document for issuing Credit.

2.开证的要求 信用证申请的要求在统一惯例中有明确规定,进口商必须确切地将其告之银行。信用证开立的指示必须完整和明确。申请人必须时刻记住跟单信用证交易是一种单据交易,而不是货物交易。

The importer will be liable to open the L/C after the parties to the import and export agree to pay by documentary L/C. The first thing is to fill in the application form for issuing Credit. This form establishes a legal relationship between the applicant and the issuing bank. Therefore, the application form is the most important document for issuing Credit.

Requirements for Opening A Letter of Credit The requirements for an application for a letter of credit are specified in the Uniform Customs and Practice that the importer must inform his bank exactly. The instructions to issue the credit must be complete and clear. The applicant must always bear in mind that a documentary credit transaction is a document transaction and not a goods transaction.

银行家不是商人,因此申请人不能希望银行工作人员能充分了解每一笔交易中的技术术语。即使他将销售合同中的所有条款都写入信用证中,如果受益人真的想欺骗,他也无法得到完全保护。这就需要银行与申请人共同努力,运用常识来避免开列对各方均显累赘的信用证。银行也应该劝阻在开立信用证时其内容套用过去已开立的信用证(套证)。

A banker is not a businessman, so an applicant cannot expect a banker to know the technical jargon of every transaction. Even if he had written all the terms of the sales contract into the letter of credit, he would not have been fully protected if the beneficiary really wanted to deceive him. This requires the bank to work with the applicant and use common sense to avoid writing letters of credit that are burdensome to all parties. Banks should also discourage issuing letters of credit in the form of letters of credit already issued in the past.