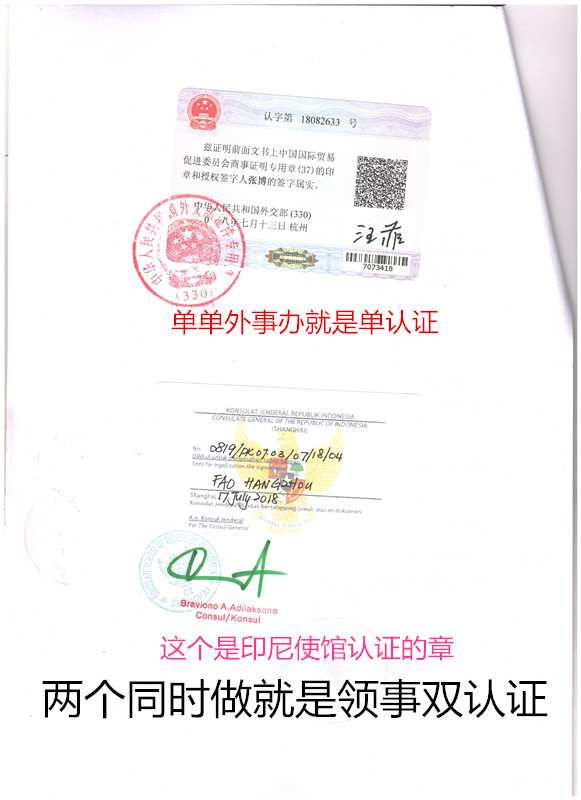

信用证AND委托书印尼大使馆盖章

大使馆认证

采用信用证结算,进口商承担的风险比出口商承担的风险更大,总体而言对出口商更有利。那么外贸卖家收到信用证之后,应该做些什么呢?

By adopting L/C settlement, the risk borne by the importer is greater than that borne by the exporter, which is more beneficial to the exporter in general. What should the foreign trade seller do after receiving the letter of credit?

首先要确定自己是否接受这张信用证。一是需要考虑开证行的信用如何,二是要核对信用证条款与合同是否相符,比如商品名称、数量、交货日期等等,如与合同不符,且条款不能接受时,及时联系对方改证。

First make sure whether you accept this letter of credit or not. One is to consider the credit of the issuing bank; the other is to check whether the terms and conditions of the L/C are consistent with the contract, such as the name of commodity, quantity, delivery date, etc. If they are inconsistent with the contract and the terms and conditions cannot be accepted, contact the other party to amend the l/C in time.

需要注意的是,信用证作为银行业务,是独立于买卖合同的。如果信用证条款与合同不符,你又按照合同出货,而没有严格照信用证条款出货,导致单证不符,开证银行是可以拒付的,且以合同条款为由进行申诉是无效的。

It should be noted that letter of credit, as a banking business, is independent of the sales contract. If the terms and conditions of the L/C are inconsistent with the contract and you ship the goods in accordance with the contract without strictly following the terms and conditions of the L/C, as a result, the issuing bank may refuse to pay, and it is invalid to appeal on the grounds of the terms and conditions of the contract.